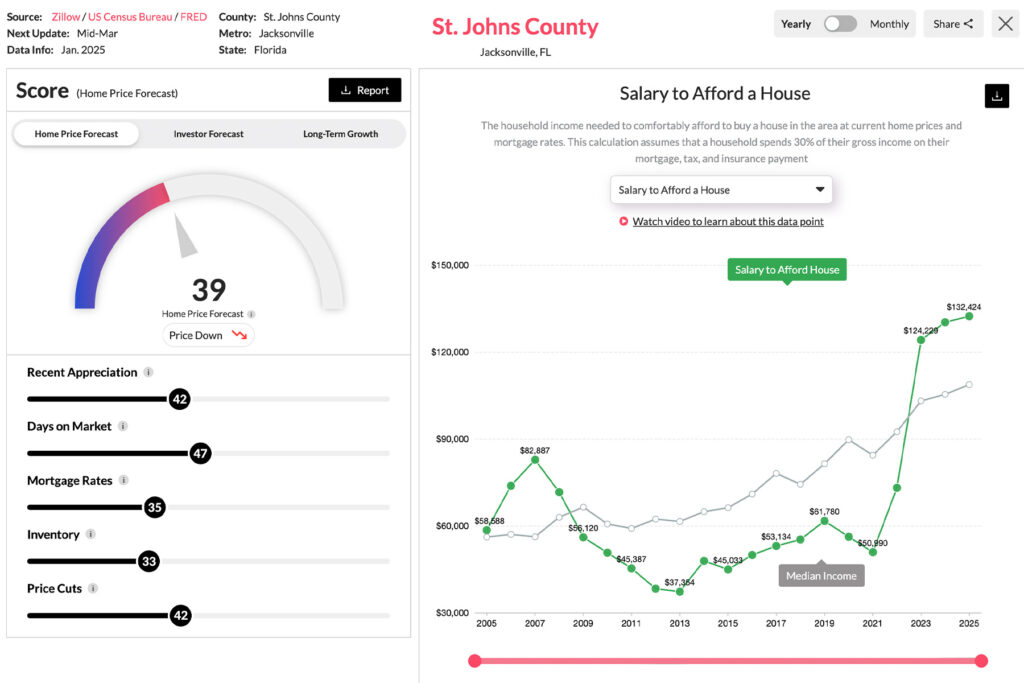

A decade ago, a St. Johns family with a household income of $45,033 could make their mortgage payment and still sleep soundly.

In 2025, that amount barely covers the annual Publix bill.

Over the past decade, the salary required to comfortably own a home in St. Johns County increased by an astounding 194% to $132,424, according to real estate analysis firm Reventure.

This calculation assumes that a household spends no more than 30% of its gross income on mortgage, taxes and insurance.

Shelling out more than that can endanger a family’s overall financial health, experts say.

From roughly 2009 to 2022, median incomes in St. Johns County were well above the salary required to make non-panic inducing home payments.

In January 2013, for example, a household only needed to pull in $37,354 to comfortably own a home while median incomes stood at $61,585.

But that proportion has flipped, with median county incomes below the level needed to own a home without financial strain.

While a household needed $132,424 in January to afford a mortgage, the median household income was $108,033.

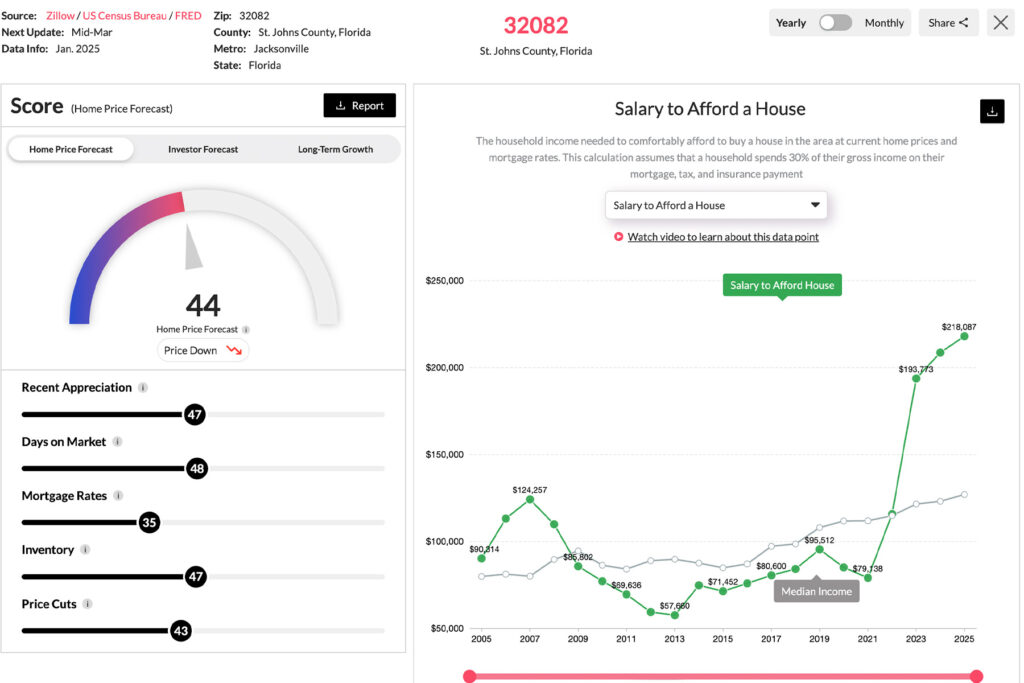

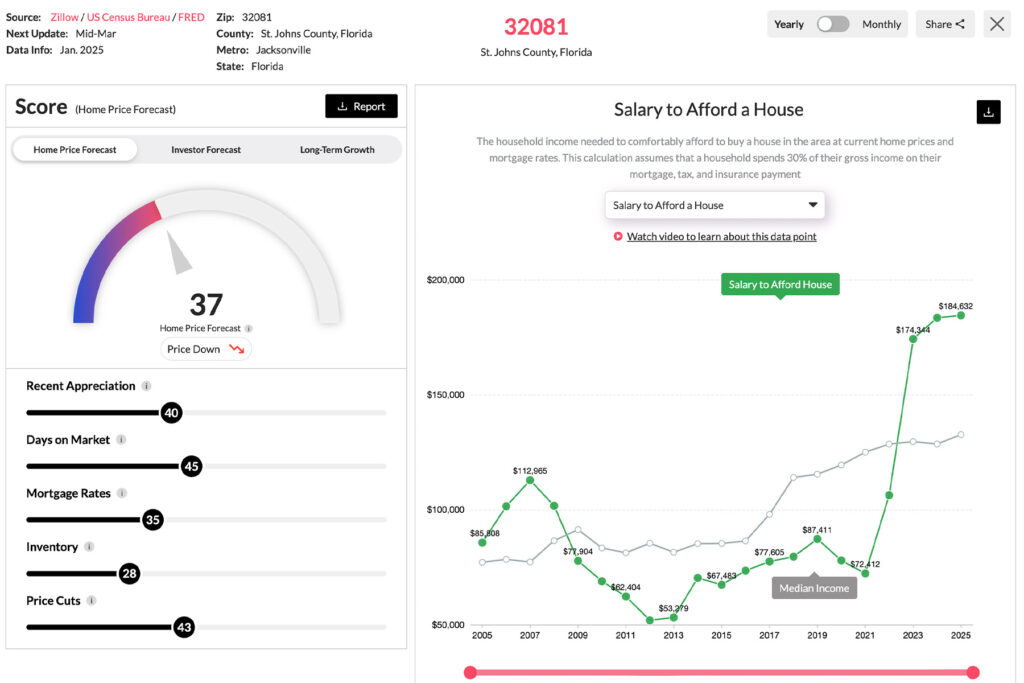

The metrics vary significantly depending on ZIP code.

To own a home in Ponte Vedra Beach’s 32082 ZIP code, a household must earn $218,087. That’s up by 205% from a decade ago when the figure stood at $71,452.

Notably, median income in Ponte Vedra Beach stood at $127,105, well below the comfortable home ownership threshold.

Nocatee homeowners in ZIP code 32081 needed to pull in $184,632 for friction-free home ownership as of January, but the median household income was $132,807.

The gross household income needed to comfortably own a home in St. Augustine was just $28,342 in 2015. That figure has jumped by 226% over the next decade and stood at $92,502 as of January.

Reventure data show that St. Johns families have been spending a much higher percentage of their income on home costs in recent years.

Just four years ago, households spent 18% of their income on home expenses.

As of January, that figure had risen to 36%.