There was a subtle but still unmistakably urgent tone in School Superintendent Tim Forson’s keynote address at a breakfast hosted by the St. Johns County Chamber of Commerce Economic Development Council.

Citing cascading growth and soaring costs, Forson argued that the passage of two November school tax referendums is pivotal for the preservation of the district’s sterling reputation.

“I’m just being honest,” he told business leaders at the World Golf Village Renaissance Resort event. “It’s about moving forward. It’s about how things are moving in public education and how we support it.”

Forson painted a picture of dizzying expansion, stressing that the county’s school population has more than doubled since 2004, increasing from 23,000 to well over 50,000 currently.

That figure is expected to rise by another 13,000 kids over the next decade.

Maintaining the county’s educational gloss, he said, will require increased funding across the board — especially for the recruitment and retention of staff.

“It’s costly for our employees to live,” he said. “Housing is expensive and housing is limited in availability. When people come in and try to set their lives up to be here and be a part of it. We’ve had historic vacancy levels for both instructional and support positions.”

Forson presented a slide comparing average teacher pay for several local counties. Putnam stood at $58,369, followed by Duval at $55,282, Putnam at $55,000 and St Johns at $53,484.

Costs, he said, are increasing in all spheres — including construction.

Pine Island Academy, which opened for the 2021-2022 school year, cost roughly $38 million. Nearly identical schools slated for construction are now running more than $60 million, Forson said.

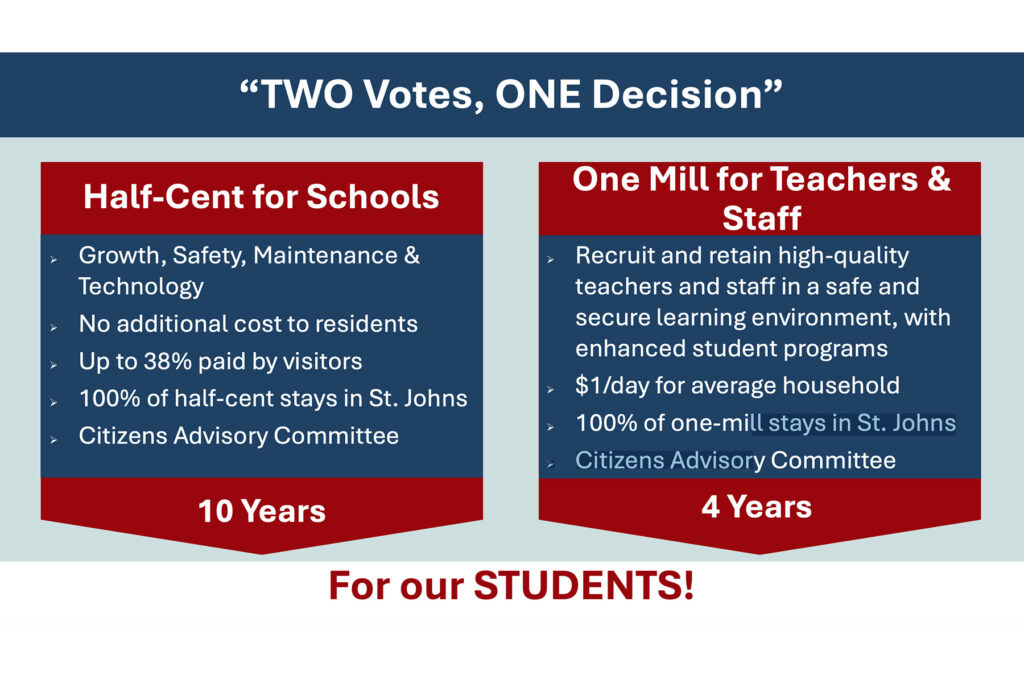

If passed on November 5, one of the measures would maintain the half-cent sales tax, which generated $37 million last year, to fund new school construction and improvements.

“That’s really important,” he said. “That would be a huge capital loss to the system.”

The other would empower the School Board to increase property tax rates to fund staff salaries and school programs. The hike would be an increase of one mill, beginning July 1, 2025, and lasting for four years.

According to the district, that would equate to a tax hike of roughly $325 a year for a home with an assessed value of $350,000.

For a $650,000 residence, the jump would amount to $625 a year.

After Nassau County implemented a millage tax, teacher pay was boosted by $2,000 to $10,000 annually based on seniority. Forson told The Citizen he expected a similar outcome for teachers in St. Johns County if the tax is passed here.

Forson, who has worked in St. Johns County schools for more than three decades, said the challenge of scaling up without cratering quality has been met thus far.

Only one other county — Sarasota — has received an A grade from the state since the system was implemented in 2024.

“We have kids in the military academies, in Ivy League schools, and the most prestigious universities in the world,” he said. “They come out of our public schools in St. Johns County.”